our focus on message security, integrity, delivery assurance, and compatibility

Key Tested Telex (KTT)

Secure and Guaranteed Settlement

Secure of the KTT Process

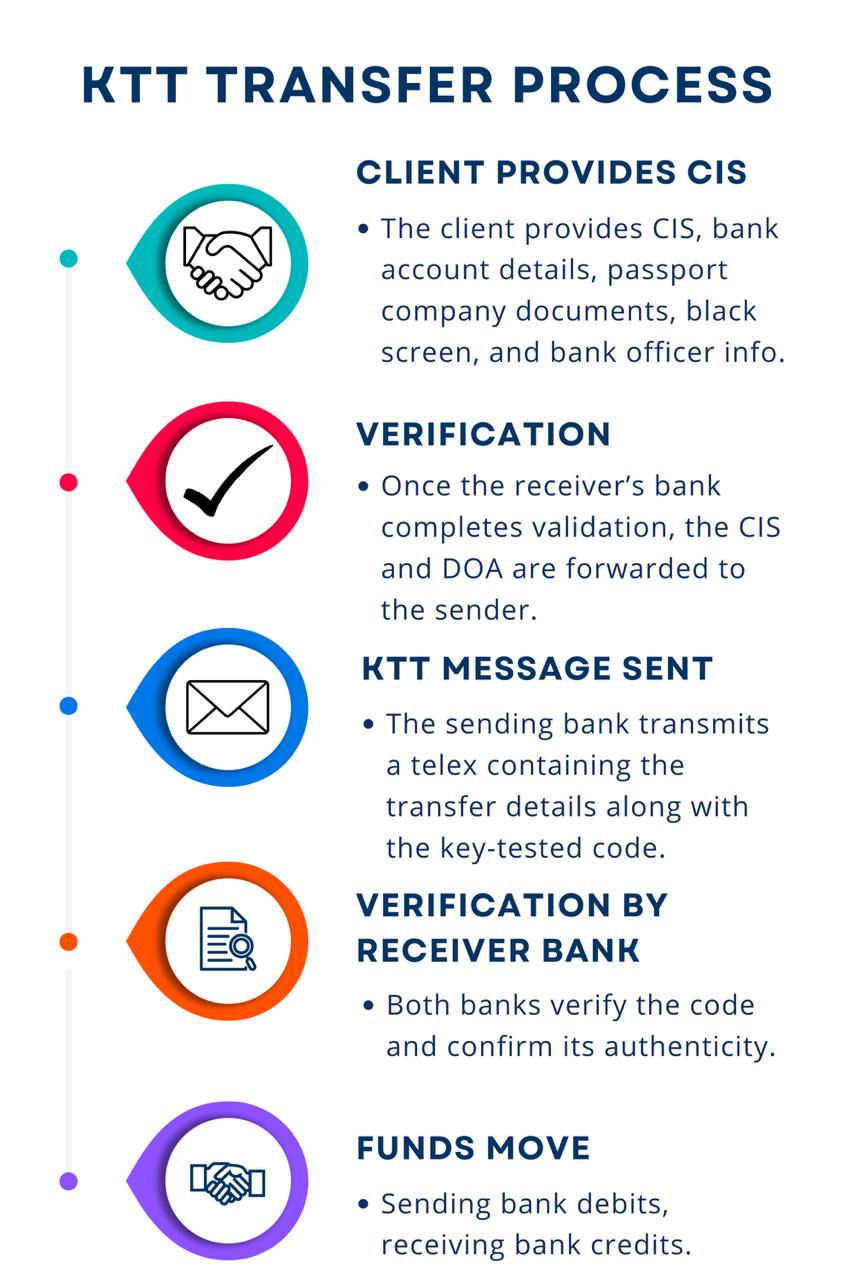

The KTT transfer is a complex financial process requiring close cooperation between banks. All CIS documents must be received and carefully verified to ensure smooth and error-free processing. With extensive experience, our team confidently manages these transfers securely.

Our Core Focus

HOW WE ARE DIFFERENT

Message Security

We prioritize protecting sensitive information through state-of-the-art encryption and secure protocols, ensuring that every message is safeguarded from unauthorized access or breaches.

Message Integrity

Every message that passes through our system is validated to ensure its authenticity and completeness, guaranteeing that no tampering or alterations occur during transmission.

Delivery Assurance

Our real-time systems provide senders with the assurance that their messages have been successfully received without delay.

Trust and Transparency

Our approach is built on fostering trust between parties. By ensuring secure, verifiable, and efficient message exchanges, we help build confidence in every interaction.

preparation

HOW TO GET START

Contact our team and send all necessary documents to our verified email. After validation, our team coordinates with the sender’s bank to initiate the key-tested telex, confirm authenticity, and complete secure fund settlement.

CLICK here to view the required documents.

Subheading

WHAT IS KTT

KTT (Key-Tested Telex) is a secure bank-to-bank method where the sender provides transfer details and a key-tested code, which the receiver verifies before authorizing the funds, ensuring authenticity and safe settlement.

RTGS: behind the scenes of real-time settlement

TRANSFER STRUCTURE

A KTT (telex) payment is only a message that tells banks what to do—debit one account and credit another—but it does not move money by itself; the real transfer happens on settlement rails like correspondent banking (banks using accounts they hold with each other), RTGS at the central bank, or RTP/clearing systems, where balances are actually shifted between banks’ accounts; so for a KTT transaction to be real, the bank must both send the instruction and complete settlement through one of these systems, after which the receiving bank credits the beneficiary.

FAQs

Before Verification

Because compliance requires sender identification before any bank-to-bank engagement. Without the sender CIS, our bank cannot open a compliance file or legally respond.

All documents are handled through compliance; no third party can access them. This protects both sender and us under AML rules.

The black screen is the only way to demonstrate that the sender’s account truly holds the claimed balance. Without seeing the sender’s black screen, our bank has no assurance that funds are real.

During Key-Test Verification

The response is typically within the same banking day, subject to system traffic and compliance checks.

Immediately after compliance clearance. Timing depends on both banks’ communication, but normally within the same business day.

The key-tested telex system protects the sender’s funds; no release occurs until both sides authenticate.

Yes, our bank issues written confirmation once verification is complete, before the sender proceeds.

Yes, our system is prepared to authenticate once the sender’s key-tested code arrives.

Yes, we matches the black screen details against the CIS to ensure accura.

Release Stage

Authentication is processed immediately upon receipt of the sender’s code; confirmation is usually completed within the same banking session.

The sender receives formal bank-to-bank confirmation once the funds are visible and authenticated on the receiver’s system.

The receiver cannot block the process; once the sender’s code matches, the transaction follows the automatic bank protocol with no manual interference.

Yes, a receipt or MT confirmation is issued by the receiver’s bank immediately after successful authentication.

Final Settlement

The sender is notified as soon as the receiving bank completes final settlement, typically within the same banking day.

A formal bank confirmation message (such as MT103 or equivalent telex confirmation) serves as proof of completed transfer.

The sender’s funds remain secure; since no release occurs without code verification, the position is fully protected and the transaction simply does not proceed.